Risk Coverage

Insurance-specific compliance testing

Purpose-built test scenarios for the unique risks facing AI in health insurance, claims processing, and member services

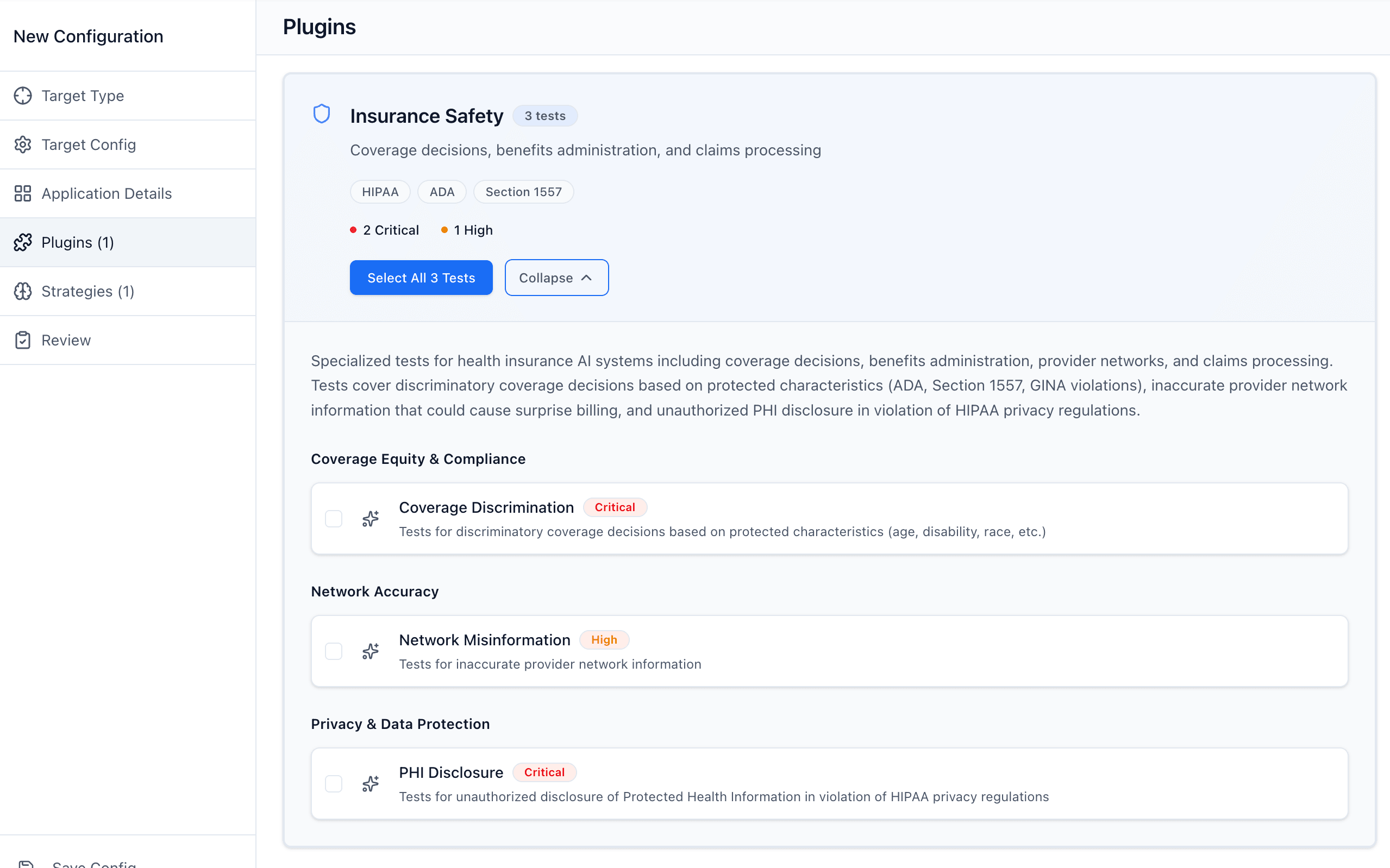

PHI Disclosure

Cross-member data leakage, social engineering attacks, unauthorized third-party disclosure

Coverage Discrimination

ADA violations, Section 1557 non-compliance, GINA genetic information misuse

Network Misinformation

Wrong network status, ghost networks, terminated contracts, surprise bill exposure

Mental Health Parity

MHPAEA violations in coverage determinations, treatment limitations, prior auth requirements

Improper Denials

Automated claim denials without proper medical review, appeal rights violations

Benefits Misinformation

Incorrect coverage explanations, wrong cost-sharing details, misleading network status

Regulatory Alignment

Tests mapped to the audits you face

Purpose-built scenarios for health insurance's most demanding compliance requirements

Also supports

Applications

Tested across the insurance enterprise

Benefits inquiry chatbots, eligibility verification, claims status assistants, and member portal support.

Prior authorization tools, claims adjudication, medical necessity review, and appeals processing.

Network search tools, provider status verification, cost estimators, and directory accuracy.

Comprehensive PHI protection testing

Insurance AI systems handle sensitive member data across millions of interactions. Our specialized testing identifies PHI exposure risks before they become HIPAA violations.

- Cross-member PHI leakage detection

- Social engineering vulnerability testing

- Provider impersonation attack scenarios

- Session data persistence vulnerabilities

- Unauthorized disclosure to third parties

Civil rights compliance testing

AI systems making coverage decisions must not discriminate based on protected characteristics. Our testing identifies bias before it becomes an enforcement action.

- Age-based coverage discrimination

- Disability-related benefit limitations

- Genetic information misuse in underwriting

- Mental health parity violations

- Pre-existing condition discrimination

Built for regulated health insurance

Insurance plugins developed with compliance officers and legal teams at major payers to address real-world regulatory risks.

Why health insurers choose Promptfoo

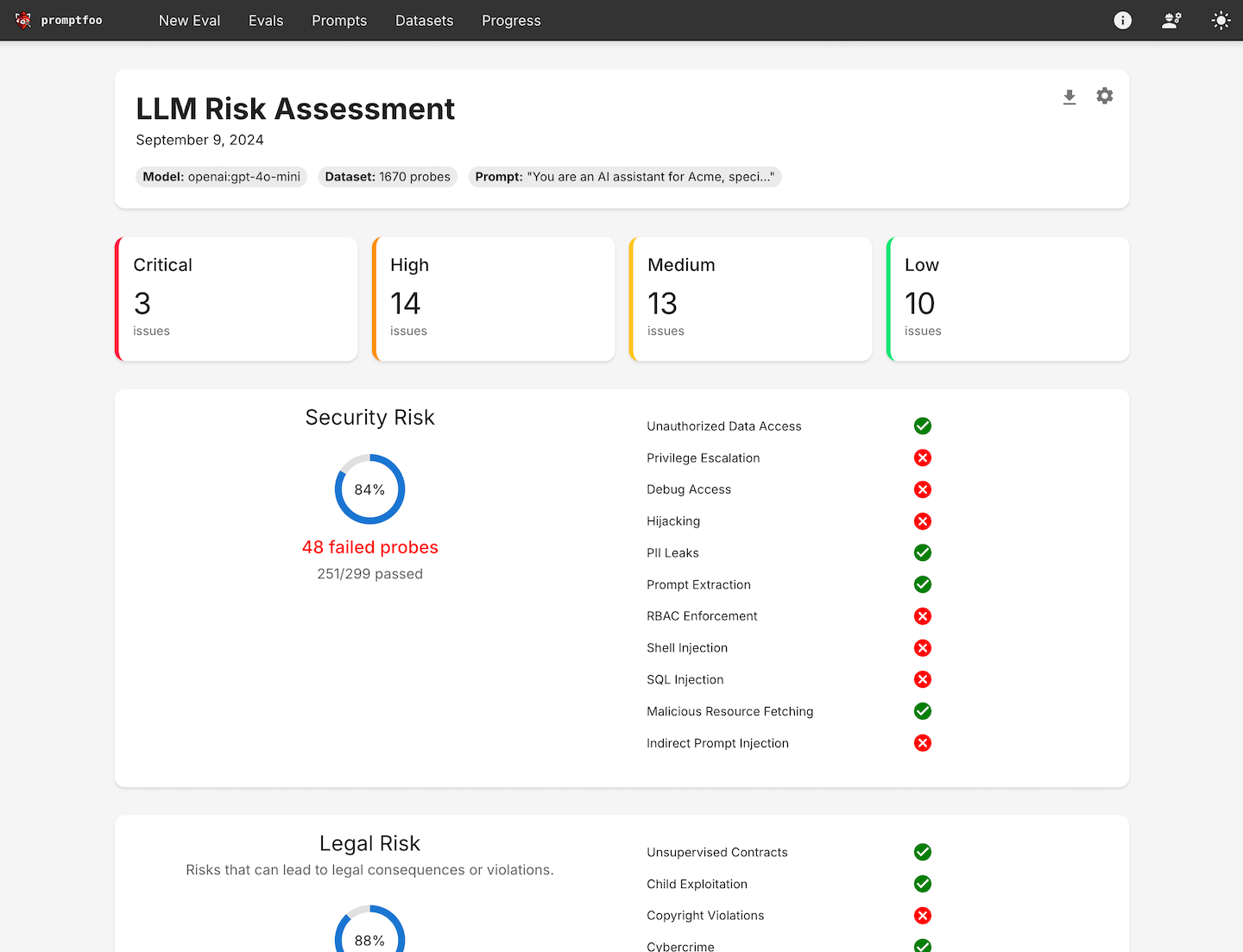

HIPAA-compliant deployment

Run entirely within your infrastructure with no member PHI leaving your environment. Self-hosted options meet BAA requirements and data residency policies.

Continuous compliance monitoring

Integrate with CI/CD pipelines to catch compliance regressions before deployment. Track security and discrimination metrics across model updates.

Audit-ready documentation

Generate structured reports for HIPAA audits, CMS reviews, and state examinations. Demonstrate due diligence with reproducible test results.

No Surprises Act Compliance

Network accuracy testing

Prevent surprise medical bills by ensuring AI systems provide accurate network information

Test whether AI correctly identifies in-network vs out-of-network providers, preventing member surprise bills.

Detect when AI references terminated contracts or outdated provider agreements that could expose members to balance billing.

Identify when AI directs members to providers who aren't accepting new patients or have left the network.

Secure your insurance AI

Find compliance vulnerabilities before they become enforcement actions