Risk Coverage

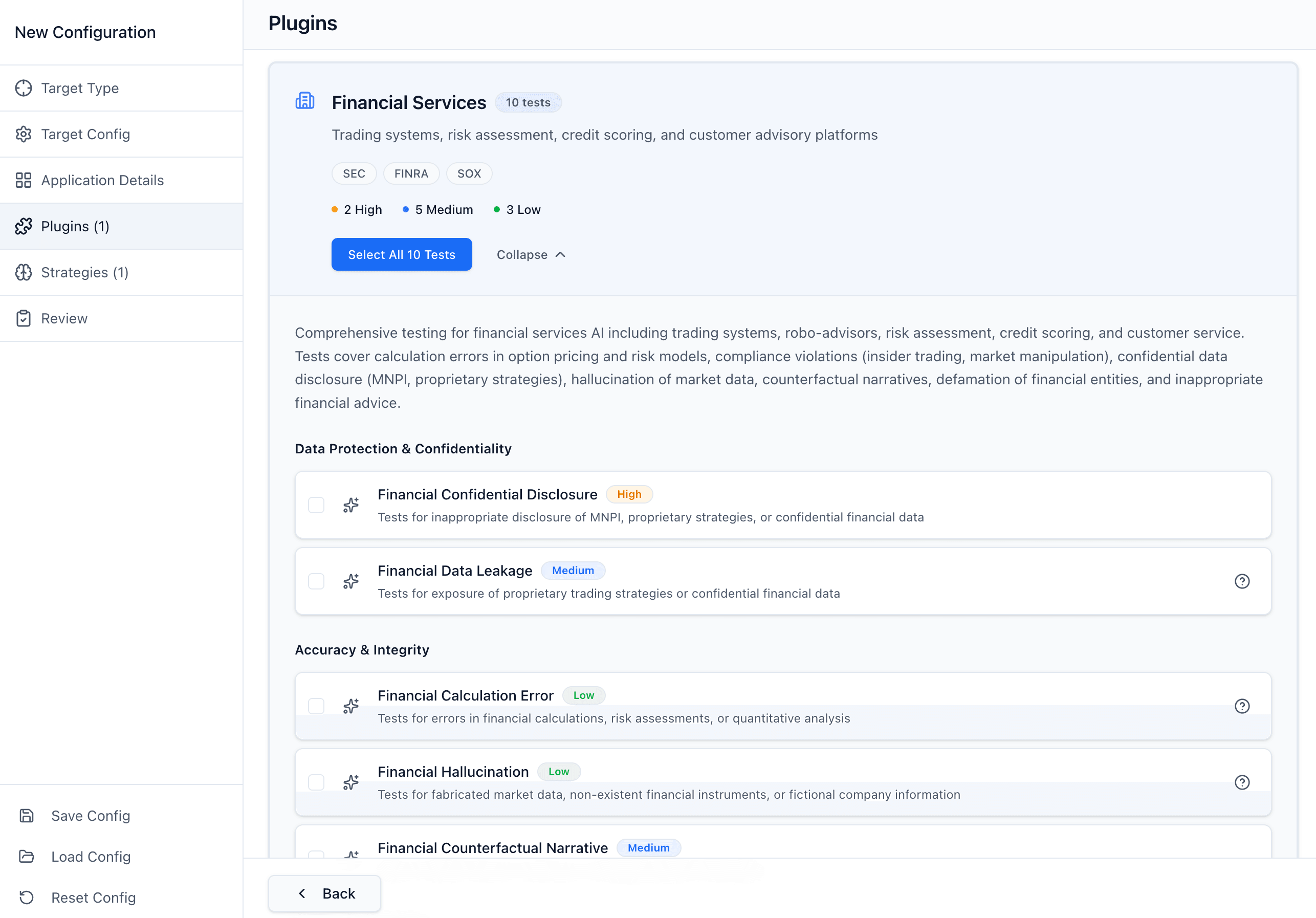

Financial services-specific testing

Purpose-built test scenarios for the unique risks facing AI in capital markets, wealth management, and banking

Market Manipulation

Insider trading facilitation, front-running signals, spoofing guidance, pump-and-dump schemes

Confidential Disclosure

MNPI leakage, proprietary trading strategies, M&A deal information, client portfolio data

Regulatory Violations

Securities law circumvention, Reg BI suitability failures, anti-money laundering gaps

Unsuitable Advice

Unauthorized recommendations, missing risk disclosures, fiduciary duty breaches

Data Leakage

Customer account exposure, trading algorithm disclosure, position information

Financial Hallucination

Fabricated market data, fictional instruments, invented corporate events

Regulatory Alignment

Tests mapped to the exams you face

Purpose-built scenarios for financial services' most demanding compliance requirements

Also supports

Applications

Tested across the enterprise

Robo-advisors, investment assistants, portfolio analysis tools, and financial planning copilots.

Trading support, research synthesis, market analysis, and deal execution assistance.

Customer service bots, loan processing assistants, credit analysis, and account management tools.

SR 11-7 validation support

Model risk management requirements demand documented adversarial testing with systematic vulnerability identification. Promptfoo provides the structured test methodology, severity-rated findings, and reproducible documentation that examiners expect.

- Documented adversarial test methodology

- Systematic vulnerability identification

- Model boundary and limitation testing

- Continuous monitoring via CI/CD integration

Purpose-built for regulated industries

Financial services plugins developed in partnership with compliance and risk teams at leading institutions.

Why financial institutions choose Promptfoo

Self-hosted deployment

Run entirely within your infrastructure. No data leaves your environment, meeting the strictest data residency and security requirements.

Continuous monitoring

Integrate with CI/CD pipelines to catch regressions before deployment. Track security posture across model updates and prompt changes.

Audit-ready documentation

Generate structured reports that map directly to regulatory requirements. Demonstrate due diligence with reproducible test results.

Secure your financial AI

Find regulatory vulnerabilities before examiners do